News Releases

BMO Financial Group has become the first Canadian bank to be granted a license to provide RMB (local currency in China) service to both foreign and local companies in China.

Issued by the China Banking Regulatory Commission (CBRC), the license enables BMO’s branch office in Guangzhou to offer a wide range of banking services such as deposits, loans, trade finance and other capital markets products to all corporations using Renminbi (RMB), China’s national currency. Previously, BMO could only provide these services in foreign currencies.

“This will allow us to offer greater access to financial services for a growing base of BMO clients who are looking to expand in China and want the expertise and resources of a strong bank on the ground that can support them in their own currency,” said William Downe, Deputy Chair, BMO Financial Group and CEO of BMO Nesbitt Burns. “The RMB license is one of many steps we have taken to demonstrate BMO’s commitment to China, a dynamic and growing market. We are confident the license will further enhance our customer relationships and make BMO a more valuable business partner.”

BMO is one of the most entrenched Canadian banks in China, with branches in Beijing, Guangzhou and Hong Kong, and a representative office in Shanghai. BMO’s long history in China dates back to the early 1800s when it completed its first foreign exchange transaction helping the United States finance its growing trade with China. Today, BMO’s deep commitment to China is reinforced by the many recent designations it has been awarded by various key organizations in the country.

- In March 2005, BMO was the only Canadian bank selected to work alongside the Bank of China, the CITIC Industrial Bank, the Industrial & Commercial Bank of China and six other international banks as a marketmaker for foreign exchange trading in China. Through the interbank China Foreign Exchange Trade System (CFETS), BMO will help lay the groundwork for trade and quote prices of eight so-called currency pairs, including dollar-sterling and euro-yen.

- In November 2004, BMO became the first Canadian bank to be granted a license by the China Banking Regulatory Commission (CBRC) to sell derivative instruments in China.

- In May 2003, BMO received approval from the China Securities Regulatory Commission to acquire an interest in Fullgoal Fund Management Company Ltd., positioning BMO as the first foreign company to acquire an interest in an established fund management firm in China. BMO subsequently increased its stake in Fullgoal to 28 per cent from 17 per cent.

BMO is also: - The first Canadian bank to participate as a marketmaker in China’s foreign exchange market starting in 2002

- The first Canadian bank in China to price and trade FX forwards

- The first Canadian bank to underwrite a domestic China bond in US Dollars

- The first Canadian and first foreign bank to enter into arrangements with EBS in China

- Ranked the No. 1 foreign bank in China’s interbank foreign exchange market for the past three years

- Ranked No. 1 amongst 16 foreign banks in Guangzhou with over 70 per cent market share of foreign exchange volume

- Ranked the 7th largest trading bank amongst all banks in China (domestic and foreign) for 2003 and 2004

About BMO Financial Group

Established in 1817 as Bank of Montreal, BMO Financial Group is a highly diversified North American financial services organization. With total assets of $292 billion as at April 30, 2005, and more than 33,000 employees, BMO provides a broad range of retail banking, wealth management and investment banking products and solutions. BMO Financial Group serves clients across Canada through its Canadian retail arm, BMO Bank of Montreal, and through BMO Nesbitt Burns, one of Canada’s leading full-service investment firms. In the United States, BMO serves clients through Chicago-based Harris, an integrated financial services organization that provides more than 1.5 million personal, business, corporate and institutional clients with banking, lending, investing, financial planning, trust administration, portfolio management, family office and wealth transfer services.

- 30 -

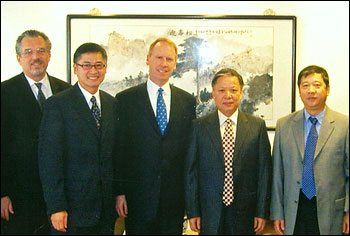

From left to right: BMO executives Robert Martin, Frankie Li and Bill Downe, Deputy Chair, BMO in China with Mr. Peng Zhijian, Director, CBRC (China Banking Regulatory Commission) Guangdong Bureau and Mr. Meng Jianbo, Deputy Director, CBRC Guangdong Bureau

From Left to Right: Frankie Li of BMO's Guangzhou office and Mr. Peng Zhijian, Director, CBRC (China Banking Regulatory Commission) Guangdong Bureau with Soren Christensen of BMO