News Releases

BEIJING, September 22, 2009 – BMO Financial Group, Canada's first bank – and the first Canadian bank to do business with China – today announced another first: BMO is the first Canadian bank to obtain the approval of the China Banking Regulatory Commission to formally prepare for incorporation of its wholly-owned subsidiary bank, with the proposed name of Bank of Montreal (China) Co. Ltd.

“Incorporation gives us an advantaged platform to grow our existing businesses and capitalize on the tremendous growth potential in China,” said Albert Yu, the recently appointed Chief Executive Officer for BMO's Asian operations. “Incorporation gives us the flexibility we want to expand our product offering, including the possibility of new initiatives in wealth management and retail banking.”

A delegation of Parliamentarians representing the all-party Canada-China Legislative Association were present for the announcement. Daryl Kramp, Member of Parliament and Co-Chair, said, “Canada and China are important trading partners and markets for each other. We are pleased to be here today, on behalf of the Parliament of Canada, to celebrate this important advancement in Canada/China business relations. This announcement provides the opportunity to build upon the mutual strength of our financial services industry.” Senator Joseph Day, Co-Chair said, “We are pleased to see Canadian companies succeed in China. Today's announcement by BMO, a company which has invested in building a long-term relationship with its Chinese partners, will help strengthen the ties between our two countries.”

“BMO has a strong and long-standing presence in Beijing,” added Mr. Yu from the bank's Asian headquarters in the Chinese capital. “BMO has had a full service branch in Beijing since 1996 and the branch was the first Canadian bank location to be granted a license to provide Renminbi (RMB) local currency service to both foreign and local companies in China. Recently, we opened expanded new premises in Beijing to accommodate our growth.”

About BMO in China

BMO's ties with China go back to 1818 – the year after its founding – when the bank undertook its first foreign exchange transaction in support of trade with China. BMO has branches in Beijing, Guangzhou, Hong Kong and Shanghai, and has a 28% equity interest in Fullgoal Fund Management Company Ltd., which manages mutual funds and pension plan assets in China. BMO is a leading market-maker for the RMB in foreign exchange trading; and it is increasingly involved in China's IPO market, having been named co-lead manager of Bank of China's 2006 IPO in Hong Kong. BMO Capital Markets' Representative Office in Beijing provides support to the Investment & Corporate Banking Coverage groups and Product groups to offer M&A advisory services and debt/equity placement/underwriting capabilities in North America to selective Chinese corporations for their overseas investment activities.

- 30 -

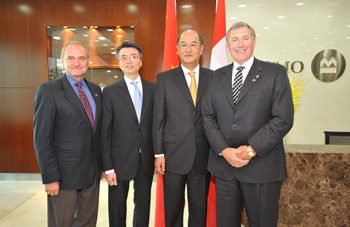

Canada-China Legislative Association visits BMO's new Beijing premises as BMO announces plans to incorporate in China, the first Canadian bank to do so. From left to right: Senator Joseph Day; Albert Yu, CEO Asia for BMO; Roger Heng, BMO General Manager in Beijing; and Daryl Kramp MP (Prince Edward-Hastings).

Canada-China Legislative Association visits BMO's new Beijing premises as BMO announces plans to incorporate in China, the first Canadian bank to do so. Albert Yu, CEO Asia for BMO (5th from right) and Roger Heng, BMO General Manager in Beijing (5th from left) greet the delegation, co-chaired by Senator Joseph Day and Daryl Kramp, MP.